Neighbor-

Property Tax Relief

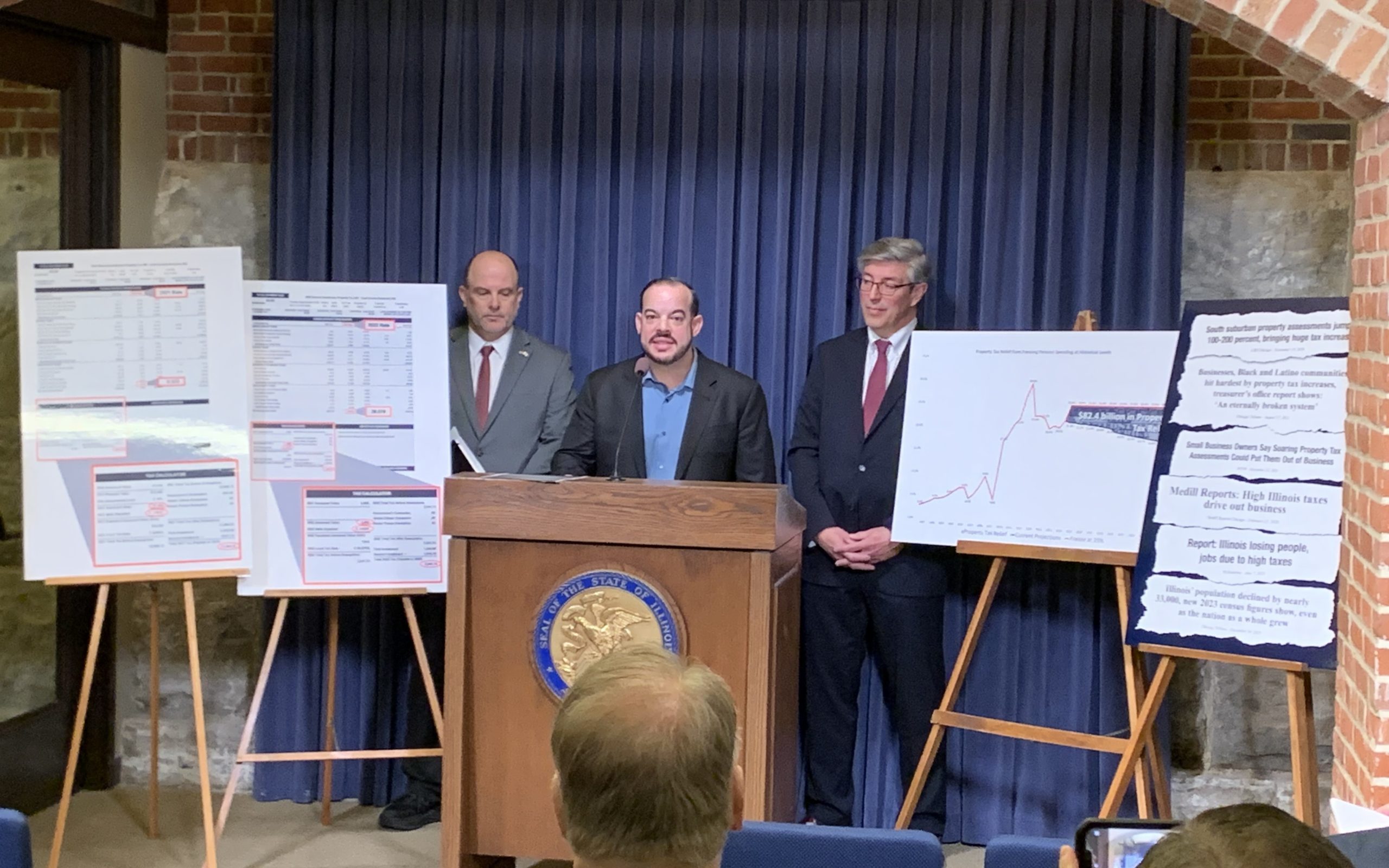

Earlier this month, I joined my colleagues State Representative Dan Ugaste and former State Representative Mark Batinick for a press conference to discuss legislation to reduce property taxes.

It’s no secret that property taxes in Illinois are out of control and unsustainable. The high property tax burden is suffocating families, communities, and businesses, especially in areas that are already struggling. But the extremes of property tax rates vary greatly across our state, sometimes even between towns in the same county. It’s time we ask – why are some struggling communities across our state paying four times the effective tax rate than more affluent communities?

This crisis is why I, along with my colleague State Representative Dan Ugaste, have introduced House Bill 4866. This legislation would create the Education Property Tax Relief Fund, which would award property tax relief grants to school districts. While all areas of the state would see significant property tax relief, the hardest hit areas would see up to a 50% reduction in school district property tax rates.

We must not stand in the way of our neighbors to believe that their kids and grandkids will do better and accomplish more than they ever hoped or dreamed. Together, we can stand up and lead the way to transform the lives of millions of individuals and families for generations to come.

To watch my remarks on this bill, click here.

State of the State and Budget Address

Last week, Governor Pritzker gave his yearly State of the State and Budget Address in Springfield. This speech allows the Governor to outline his priorities for this year, along with offering a proposed budget for the upcoming fiscal year.

While a large portion of his speech was focused on divisive political rhetoric, he did offer his plans for a budget. His budget address made one thing abundantly clear: Governor Pritzker is out of touch with the needs of Illinoisans.

Illinoisans do not need more spending on social programs, like the Illinois Arts Council, they need real economic relief, pension reform, and extended funding for school choice programs like Invest in Kids.

Here are some of the important points from his address:

- This is the largest state budget in history at a proposed $52.7 billion, which is a 4.5% increase from last year.

- This budget is operating on a $775 million deficit.

- The Governor proposed over $1 billion in new taxes and other budget gimmicks in an attempt to sustain the uncontrollable spending we have seen over the past four years.

- More funding for the migrant crisis, with a predicted total of $2.8 million over the past 3 years.

The Governor bragged that Illinois’ fiscal house is in order, yet hard-working Illinoisans are struggling to afford their own homes. We need bold solutions that fundamentally reform Illinois into a place where every family has the opportunity to flourish economically and pursue their dreams.

Invest in Veterans Week | March 1-7

Invest in Veterans Week honors the aspiring and established businesses owned by veterans of our armed forces. This week is a great time to support your favorite veteran-owned business!

Keep Up to Date

Click here to visit my website. There you can contact my office, see what legislation I am working on, and more.

I will continue to update you monthly via this e-newsletter about events and programs I will be hosting throughout the year, as well as important information regarding upcoming legislation.

Talk to you soon,

State Representative Tim Ozinga